Transform messy claims data into clear actionable insights - for faster ROI & audit-ready lineage

What data leaders think about Praxi.ai:

Eric Kavanagh

CEO,

The Bloor Group

"Praxi is the key to unlocking a company’s data resources. It turns an information graveyard into a fertile field of discovery”

Angus Gow

CTO of Love Finance &

Co-Founder of Flow Foundry

"I've seen firsthand how poor data quality stifles innovation and slows down decision-making. Praxi's CaaS solution is a game-changer."

Head of Department

Defense Health

Agency

"Praxi.ai lifted DMHRSi timecard accuracy and gave clinicians time back for patients - now we’re evaluating scale-up across DoD hospitals and clinics."

When AI projects fail, it’s not the model - it’s the data

Are your insurance data transformation projects taking 12 months to ROI?

42%

of enterprise AI initiatives fail

to generate ROI

70%

of enterprise AI initiatives fall

short of targets

Most AI initiatives fail but insurers can beat the odds and shorten the time to ROI from 12 months to 12 days!

Introducing Praxi.ai - your invisible data team extension

Most insurance AI projects miss the mark due to bad quality uncurated data.

Our platform acts as an invisible data team extension for Mutual P&C insurers — working in the background to curate messy data and enforce compliance.

What you get, in plain numbers:

40 – 60% fewer audit review hours with policy-aware workflows and regulator-ready evidence packs

30 bps loss-ratio lift in targeted books by cutting fraud leakage and rework

Seven-figure fine exposure avoided through immutable decision logs, PII safeguards, region/LOB isolation, and human-in-the-loop approvals

How the “invisible data team” works

Praxi.ai runs as always-on automation across your existing stack: it discovers and cleans data, classifies sensitive information, builds lineage and glossaries, and auto-generates the audit trail every decision needs.

Your data team sees: cleaner inputs, faster reviews, fewer escalations.

Regulators see: traceability.

Finance sees: ROI

30 tools later… still no ROI? Let’s fix that 🤯

We’ve spoken to hundreds of data teams working in insurance & regulated industries and there are

3 reoccurring topics:

Too many tools → Data teams spend more time integrating than analyzing.

No ROI clarity → Execs lose trust in data programs.

Compliance risk → One bad dataset = costly fines.

Sound familiar? Here’s how insurers are cutting tool bloat by 70% — Praxi.ai replaces dozens of disconnected tools with one always-on data layer — built for insurers who need clarity, compliance and ROI fast.

Tools galore

On average, a data team will have access to between 12 and 30 different tools and apps spread across the data lifecycle.

No profitability

Despite investing in many tools, there is no clear vision of how these tools deliver outcomes, retain policyholders or deliver any ROI.

High risk

Siloed data and complex tech stack leads to compliance risk. How would a $1.5M HIPAA fine reflect on your data team?

Praxi.ai turns data quality into ROI

+ real competitive advantage for insurers.

Automated Metadata Discovery, Matching & Action

Always-On Regulatory Classification

Pre-trained for Insurance, No model building required

Simple 3-step approach

to insurance data curation

Discover

Find hidden policy, claims, and customer data across systems - structured or unstructured - to reveal risks, opportunities, and compliance issues insurers often miss.

Understand

Profile and classify sensitive data with insurance-specific business terms, exposing quality gaps and compliance risks so underwriters, claims teams, and regulators can trust every decision.

Act

Automate alerts, compliance flags, and renewal insights to improve retention, reduce regulatory risk, and ensure clean, trusted data drives underwriting, claims, and strategic decisions.

Trusted by leading insurers because Praxi.ai helps:

1. retain policyholders at lower cost

The Problem: it’s much cheaper to retain existing customers rather than obtain new ones. Renewals are rarely straightforward. Poor data makes it hard to identify customers at risk of leaving.

Praxi Service: Complex terms engine + automated discovery of renewal data across disjointed legacy systems.

Outcome: Surface every policyholder up for renewal, fix bad records before outreach, and reduce churn by keeping more customers.

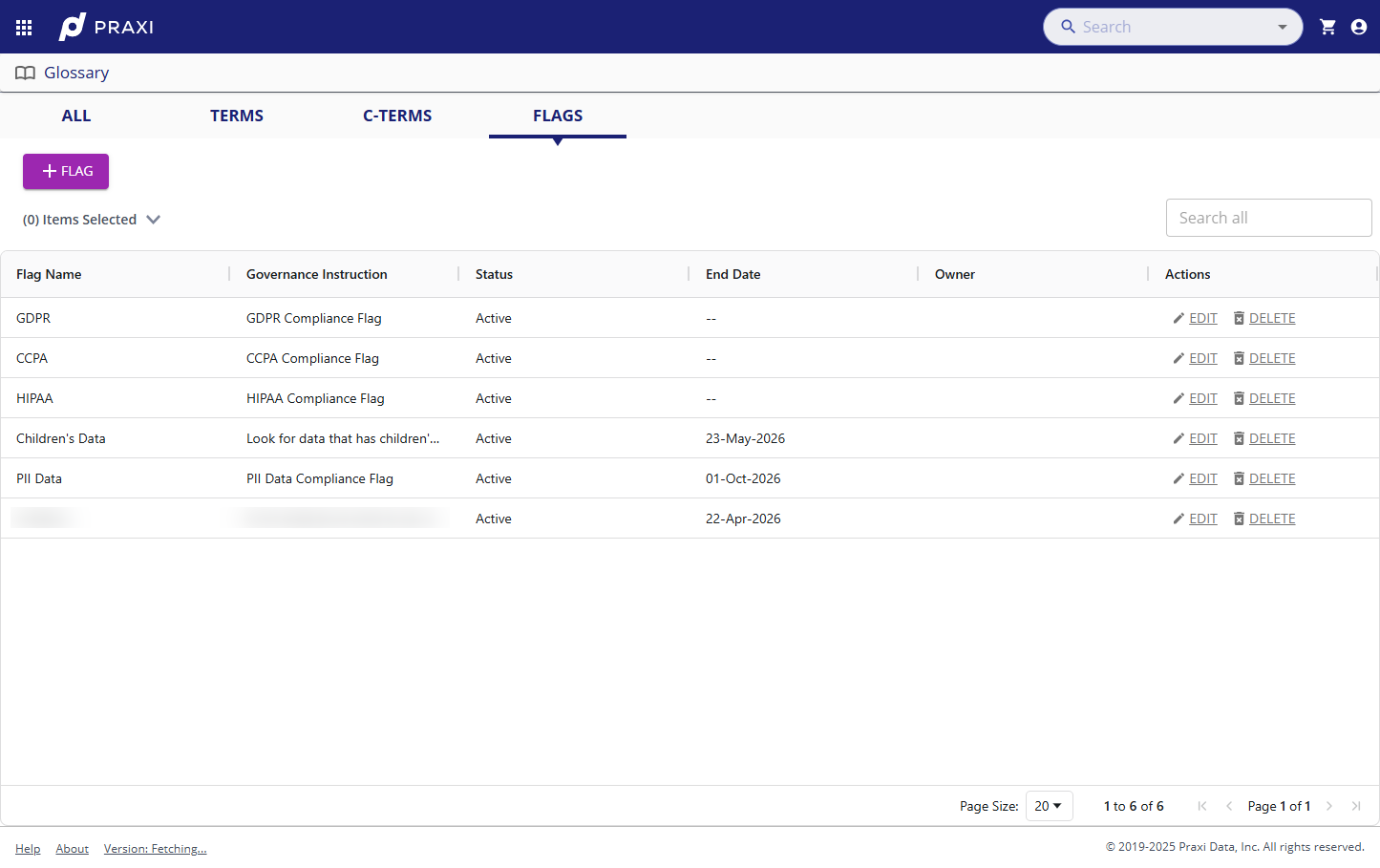

2. stay ahead of regulatory risk

The Problem: Compliance with GDPR, CCPA, and HIPAA is high-stakes -fines reaching millions of dollars, and reputational damage loom over every insurer.

Praxi Service: Automated data classification + regulatory flags built into every workflow.

Outcome: Every policy, claim, and customer record is automatically tagged and monitored for compliance, reducing risk of violations.

3. trust every decision with curated data

The Problem: Pricing errors and delayed claims come from duplicate, incomplete, or low-quality data.

Praxi Service: Continuous quality checks across structured, unstructured, and semi-structured data.

Outcome: Underwriters and actuaries work with trusted data, leading to more accurate pricing and fewer costly mistakes.

Let’s book a demo, however in the meantime…

Improved Data Governance

Ensure compliance and reduce risk with our GDPR-aligned data management.

Enhanced ROI on Analytics

Unlock the full potential of your data, leading to smarter, more profitable decisions.

Automated Data Curation

Save time and resources with our automated, expert-driven data classification.

Before & after Praxi.ai: outcomes we deliver for data teams

What does your day-to-day look like with or without Praxi.ai data curation platform - depending on your role within the Data Team

For your data team roles...

| Role | Without Praxi | With Praxi | Impact |

|---|---|---|---|

| Data Analyst | 4–6 hrs/day cleaning, reconciling data | Curated datasets delivered instantly | 50–60% time saved |

| Data Steward | Manual cataloging, chasing owners | Automated classification & lineage | 70% manual work eliminated |

| Data Engineer | Pipeline break/fix, heavy QA burden | Auto profiling + drift detection | 30–40% less maintenance |

| Claims Analyst | Hunting missing/incomplete claim data | Curated claims feeds | 30–50% faster investigations |

| Underwriter | Manual reconciliation of applicant data | Auto-curated risk profiles | 40% faster case handling |

| Compliance Officer | Painful manual audit prep | Continuous audit-ready logs | 80% less audit effort |

... and for the exec roles within your business

| Role | Without Praxi | With Praxi |

|---|---|---|

| Chief Data Officer | Firefighting poor data trust; high data spend waste | Trusted AI-ready foundation; drives innovation & growth |

| Chief Claims Officer | Lagging KPIs, fraud/leakage blind spots | Real-time curated claims intelligence |

| Chief Compliance Officer | Costly, manual, siloed compliance evidence | One-click audit-ready dashboards |

| Head of Claims | Slow cycle times, inconsistent data quality | Standardized, faster claims processes |

| Head of Underwriting | Incomplete risk views, slow new business | Curated datasets for faster, better risk decisions |

Metadata: the secret fingerprint that unlocks ROI

For insurance companies, unstructured data isn’t just messy - it’s a hidden risk. Without clear structure, customer profiles remain inconsistent, claims decisions become subjective and identifying fraudulent activity requires time-consuming manual effort.

Our AI-powered data curation solution creates order where there is chaos. By applying smart metadata, we help you:

✅ Define What Matters – Establish clear hierarchies within your data, identify patterns, identify good vs. bad customer profiles.

✅ Automate Data Discovery – Streamline document processing and continuously scan and structure incoming data to ensure accuracy and reliability.

✅ Streamline Decision-Making – Instantly flag high-risk claims, reducing manual reviews and reducing fraud.

✅ Stay Compliant & Efficient – Organize data without exposing sensitive information - we analyze the fingerprint of your data, not the data itself.

Stop drowning in unstructured data and identify patterns.

Let AI-driven metadata unlock efficiency, accuracy and smarter decisions in your insurance data operations. Start a free trial today.

Improving Underwriting Processes with AI

Underwriting - it’s one of the most essential parts of the insurance business, involving evaluating risks and setting policy terms. But, let's face it, it can get pretty tedious. That’s where AI comes into play. It’s changing the game by automating repetitive tasks and taking data analysis to a whole new level.

Underwriting that's faster, smarter and more precise.

By cutting down on manual work, AI frees up underwriters to focus on the bigger picture - complex decision-making and improving strategies.

Ensuring Compliance Without the Hassle

The insurance industry and regulations go hand in hand - it’s the nature of the beast.

But keeping up with complex legal requirements for data protection and compliance can be overwhelming. Here’s where artificial intelligence shines again. It can monitor compliance in real-time and even generate those tedious reports automatically.

If you’re worried about staying on top of privacy rules or managing sensitive data securely, AI’s got you covered. With built-in compliance features, these systems help insurers stick to the rules while avoiding costly penalties. Plus, AI makes audit processes a breeze by flagging issues as they come up and handling massive amounts of compliance data without breaking a sweat.

An important bonus? artificial intelligence offers flexible solutions for today’s scattered workforce.

Whether underwriters are working from home or the office, AI ensures claims data stays encrypted, is accessed securely and meets all necessary security standards.

That level of protection keeps both the business and its customers safe.

Our partners

-

AI-driven data curation can transform how insurers manage risk and make decisions. By streamlining how data is processed and used, it gives businesses a real competitive edge.

-

Manual claims processing, detecting fraud, ensuring cybersecurity and keeping up with regulations are some of the key struggles. Tackling these bottlenecks is essential to boost efficiency and maintain trust with customers.

-

AI-powered platforms automate routine tasks and use predictive analytics, leading to quicker processing and better accuracy in both claims operations and underwriting.

-

Insurers often struggle to keep up with complex regulations like GDPR and CCPA. Getting compliance wrong can be costly and disruptive, so addressing these requirements head-on is crucial.

-

On average, AI can speed up policy approvals by 20%, boost accuracy in risk assessments and significantly improve overall customer satisfaction.

-

Venturing into AI for your insurance company is no small feat, but by taking it one step at a time, you’ll set yourself up for success. Start by truly understanding your workflows, pick scalable and secure tools and always test before going big. Done right, AI can reshape how your business operates, allowing you to work smarter, stay competitive and - most importantly - deliver a better experience for your customers.